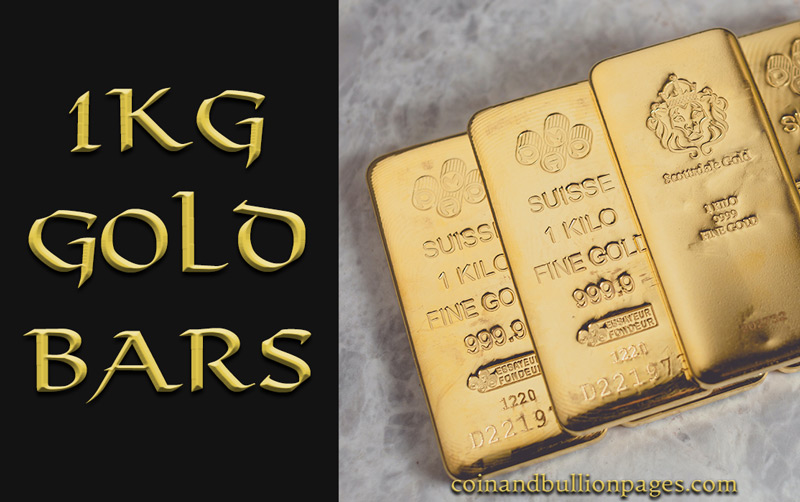

PAMP Suisse and Scottsdale 1 Kilo Gold Bars Image – scottsdalemint.com (via Unsplash)

Weighing 32.1507 Troy Ounces, the 1 kilo gold bar is a very popular option for serious bullion investors. 1 kilo gold bars, also known sometimes simply as “kilobars” are produced by major gold bullion manufacturers of the world. The bars are typically branded either with the stamp of the manufacturer, or that of a bank. Well known kilobar “brands” include UBS (Union Bank of Switzerland), Royal Mint, Heraeus, PAMP Suisse, Johnson Matthey and several others.

As with other gold bullion bars, 1 kilo gold bars are typically manufactured at 24 karat, also known as “four nines fine” or “999.9” fine – which indicates that the bar is at least 99.99% pure gold. This figure is marked on the bar along with the weight, assayers mark, manufacturer’s logo and (typically) a serial number.

Buying 1 Kilo Gold Bars

One of the advantages of larger gold bars such as the 1-kilo, is that they carry a lower premium over spot than smaller bars. However, you have to be something of a serious investor to get your foot in the door: At late 2023 prices of around $2000 per Troy ounce, just one of these bars would set you back over $60,000 plus the bullion dealer’s premium, which may well be around another $1000 (or possibly even more than $2000 if purchasing with a credit card, for which bullion traders very often place an extra fee).

There may be tax benefits available, depending on your region: Since 2000 AD, all gold bullion (bars and coins) sold by the Royal Mint (UK) is VAT-free. However note than in the UK, only gold bullion coins are exempt from capital gains tax.

1 kilo gold bars are widely available online and by phone – and once you have done the hard part (which is of course obtaining sufficient capital), ordering would appear to be a relatively simple process. You should expect standard KYC (Know Your Customer) procedures such as thorough ID verification and establishment of legitimate funds.

It is strongly suggested to buy from one of the well-established bullion traders or mints – as they have a long reputation of service. Curiously, a quick search on Ebay shows that gold plated copper replicas weighing 8 ounces can be obtained for $40 – however it is possible that these too may be prohibited in future despite being clearly stated as replicas.

It is very unlikely that you would see a genuine gold bar for sale at significantly less than the current spot price – for the simple reason that genuine bullion can be sold to an authorized outlet for a price close to the spot.

Selling 1 Kilo Gold Bars

1 kilo gold bars are considered a highly liquid commodity. This means that they are traded readily and can be converted into their cash equivalent through reputable bullion dealers and mints.

1 kilo of gold is 32.150746568627981 Troy Ounces and the spot price of one ounce of fine gold should be multiplied by this number in order to calculate the current value of your kilobar.

If you are selling 1 kilo gold bars, you will not realise the “spot price” exactly, but will receive a quote for a “buy back price” from a bullion dealer (typically around 96-97%). For this type of gold bar, at an approximate spot price of $2,000 per troy ounce, the buy back price at 97% would be $1,929 less than the equivalent spot price.

So with the differences between buy and sell prices, you will need for the price of gold to have risen a certain amount before you “make your money back.” Let’s say for example you bought one of these bars when the spot price was $1700 / ozt. You would need to sell when the price was $1746 / ozt in order for a dealer premium of $1000 and a buyback deduction of $500 to be covered.

1 Kilo Gold Bar Dimensions

1 kilo gold bars, like other gold bars, are surprising in how small they are for their weight: They are typically 8cm long, 4 cm wide and 1.8 cm deep – smaller than a cell phone.